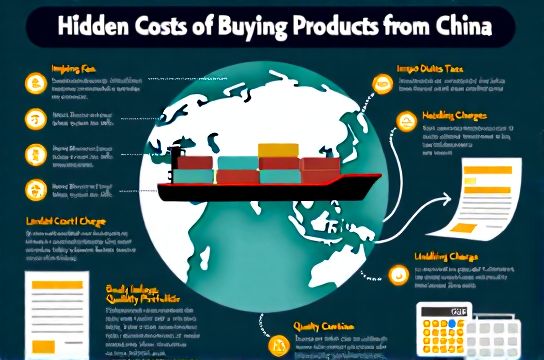

Hidden Costs of Buying from China You Must Know

- 时间:

- 浏览:40

- 来源:OrientDeck

So you're thinking about sourcing products from China? Smart move. With competitive manufacturing, fast production times, and a massive range of suppliers, it's no wonder businesses worldwide flock to Chinese factories. But hold up—before you start dreaming of fat profit margins, let’s talk about the hidden costs that could quietly eat into your budget.

The Real Price Tag Behind 'Cheap' Manufacturing

Yes, the unit price might look amazing on paper. A $2 widget sounds like a steal—until shipping, taxes, and quality issues turn it into a $5 headache. Let’s break down what most buyers overlook.

1. Shipping & Logistics: The Silent Budget Killer

You’ve got options: air freight (fast but pricey), sea freight (slow but cost-effective). But don’t forget fuel surcharges, port fees, and handling costs. A $1,000 shipment can easily rack up an extra 30–50% in logistics.

2. Import Duties & Taxes

This one stings. Depending on your country, import duties can range from 5% to 25%. For example, the U.S. imposes tariffs on certain electronics and textiles. Plus, VAT or GST applies in many regions—often calculated on the total landed cost, not just product value.

3. Quality Control = Money Well Spent

Cheap goods often mean inconsistent quality. Skipping third-party inspections might save $200 now, but a batch of defective items could cost thousands in returns or lost customers. Pro tip: Invest in QC early.

4. MOQs and Inventory Risk

Many Chinese suppliers require Minimum Order Quantities (MOQs). That ‘$2’ widget? You might need to buy 1,000 units. Suddenly, your $2,000 inventory sits unsold. Cash flow risk? Real.

5. Communication & Time Zone Gaps

Endless emails, translation errors, delayed responses—these inefficiencies cost time, and time is money. Misunderstandings lead to wrong specs, delays, and reorders.

Landed Cost Breakdown (Example: 1,000 Units)

| Cost Factor | Amount (USD) |

|---|---|

| Product Cost (1,000 × $2) | $2,000 |

| Shipping (Sea Freight) | $600 |

| Import Duty (10%) | $260 |

| VAT (15% on landed cost) | $429 |

| Quality Inspection | $200 |

| Total Landed Cost | $3,489 |

That’s $3.49 per unit—not $2. Big difference.

How to Minimize Hidden Costs

- Negotiate MOQs: Start small with sample runs.

- Use FOB Pricing: Clarify if prices are FOB (Free on Board) or EXW (Ex-Works)—shipping responsibility matters.

- Factor in All Fees Early: Use a landed cost calculator before placing orders.

- Build Relationships: Trusted suppliers offer better terms and communication.

Sourcing from China isn’t inherently risky—but ignorance is. Do your homework, plan for the unseen, and you’ll unlock real value without the financial surprises.