Customs Rules When You Buy from China Explained

- 时间:

- 浏览:81

- 来源:OrientDeck

So you've found an awesome deal on a product from China—maybe it's electronics, fashion, or even quirky home gadgets. Sweet! But before you hit that 'Buy Now' button, there’s one not-so-glamorous detail you can’t ignore: customs rules. Yep, those sneaky fees and paperwork that can turn your bargain buy into a budget buster.

Why Customs Even Matters

Every time something crosses international borders, governments want a say—and often, a cut. When you buy from China, whether through AliExpress, Alibaba, or another platform, your package may be subject to import duties, taxes, and customs inspections. Ignoring this? That’s how surprise charges show up in your inbox.

Key Factors That Trigger Customs Fees

- Item Value: Most countries have a de minimis value—a threshold under which no duties apply. In the U.S., it’s $800. In the EU? Just €150. Stay under, and you might skate free.

- Product Type: Some items (like textiles, alcohol, or electronics) attract higher scrutiny and tariffs.

- Shipping Method: Express couriers (DHL, FedEx) are more likely to assess fees upfront than standard postal services.

Who Pays the Pipers? You or the Seller?

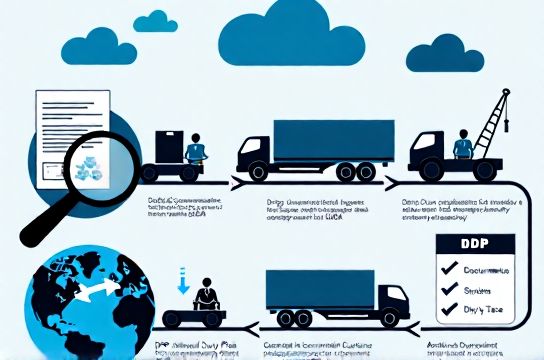

This is where things get tricky. If you're buying on platforms like AliExpress, many sellers offer DDP (Delivered Duty Paid) shipping—meaning they cover all fees. But if it’s DDU (Delivered Duty Unpaid), guess who gets the bill? Yep, you.

Pro tip: Always check the shipping terms before checkout. Look for phrases like 'No additional import fees' or 'Import charges included.'

Real-World Cost Breakdown (U.S. & EU)

To keep it real, here’s how much you might actually pay depending on where you live:

| Country | De Minimis Value | Avg. VAT/Tax Rate | Typical Handling Fee |

|---|---|---|---|

| United States | $800 | 0%–7.5% (duty) | $0–$10 (if cleared by USPS) |

| Germany (EU) | €150 | 19% VAT + possible duties | €10–€30 |

| Canada | CAD 20 | 5% GST + duties | CAD 9.95–19.95 |

| Australia | AUD 1,000 | 10% GST on goods over AUD 1,000 | AUD 20–30 |

Notice how Canada’s low de minimis means almost every personal import gets taxed? Ouch.

How to Avoid (or Minimize) Surprise Charges

- Split Your Orders: Keep individual packages under the de minimis limit.

- Choose DDP Shipping: Worth paying a few extra bucks to avoid hassle.

- Use a Parcel Forwarder: Some services consolidate shipments and optimize routing.

- Declare Accurately: Sellers marking items as 'gifts' or 'low value' to dodge fees? Risky—and could lead to delays or penalties.

The Bottom Line

Buying from China can still be a win—if you play smart. Understand your country’s customs rules, watch the total landed cost (item + shipping + fees), and always read the fine print. A $30 gadget isn’t such a steal when a $25 duty tag shows up.

Stay informed, stay under limits, and happy (and savvy) shopping!