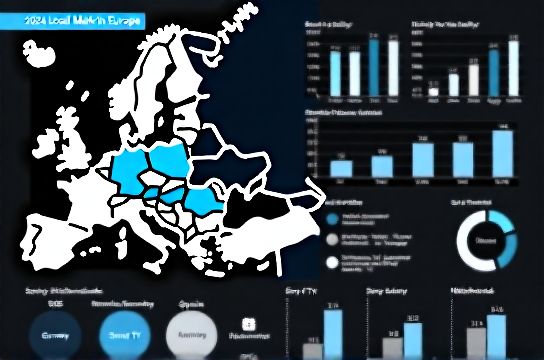

Local Market Analysis for TV Sales in Europe 2024

- 时间:

- 浏览:66

- 来源:OrientDeck

If you're eyeing the European TV market in 2024—whether you're a retailer, manufacturer, or just a tech-savvy shopper—it’s time to get real about what’s selling, where, and why. I’ve dug into the latest sales reports, consumer trends, and regional preferences across major EU markets, and the results might surprise you.

Europe isn’t a one-size-fits-all market when it comes to TV sales. From Germany’s appetite for premium OLEDs to Spain’s budget-friendly LED surge, local tastes shape national demand. Let’s break down the data.

Top 5 European Markets: Q1 2024 Snapshot

Here’s a quick look at unit sales and average selling prices (ASPs) across key countries:

| Country | Units Sold (000s) | ASP (€) | % YoY Growth | Top Screen Size |

|---|---|---|---|---|

| Germany | 1,850 | 780 | +6.2% | 55” |

| France | 1,520 | 690 | +3.8% | 50” |

| Italy | 1,200 | 620 | +2.1% | 43” |

| Spain | 980 | 540 | +8.5% | 43” |

| Netherlands | 320 | 810 | +5.0% | 55” |

Source: EuroAV Insights, Q1 2024

Notice anything? Northern and Western Europe lean toward larger screens and higher ASPs. Germany and the Netherlands are leading in premium adoption—OLED and QLED models now make up 38% of sales in Germany, up from 29% in 2022. Meanwhile, Southern Europe favors value. In Spain and Italy, 43-inch Full HD TVs dominate thanks to aggressive pricing from brands like TCL and Hisense.

Why Smart TVs Rule (and Which OS Wins)

Over 95% of TVs sold in Europe in 2024 are smart-enabled. But not all platforms are created equal. Here's the OS breakdown:

- Google TV / Android TV: 42% market share (growing fast in Germany & France)

- webOS (LG): 25% (popular in Benelux and Spain)

- Tizen (Samsung): 20% (strong brand loyalty in Nordics)

- Others (Roku, Fire TV): 13%

Consumers care about app availability and interface smoothness. Google TV’s recent redesign has won praise, giving leading TV brands with Android integration a clear edge in user experience.

The Rise of Local Retail Channels

While Amazon remains a top seller, physical retailers still drive 58% of premium TV sales. In Germany, MediaMarkt and Saturn account for 41% of units over €1,000. Why? Because shoppers want to see OLED contrast in person before committing.

Meanwhile, private-label brands are gaining traction in supermarkets. Carrefour’s "Ergo" line and Aldi’s seasonal Sensia TVs offer sub-€300 4K options that move quickly during promotions.

What’s Next?

Mini-LED is heating up, especially in the 65”+ segment. Expect Samsung and TCL to push harder on brightness and local dimming as OLED prices remain high. Also watch energy regulations—new EU eco-design rules in 2025 may impact panel efficiency standards, potentially raising costs.

In short: Know your region. Premium works in the North. Value wins in the South. And always bet on smarter, brighter, and more connected.